Investment Approach

Delivering solutions, unlocking opportunity

Lone Star is an experienced value investor, investing globally in private equity, credit and real estate for 30 years. The firm is adept at finding opportunities for value investing that provide scope for significant improvement.

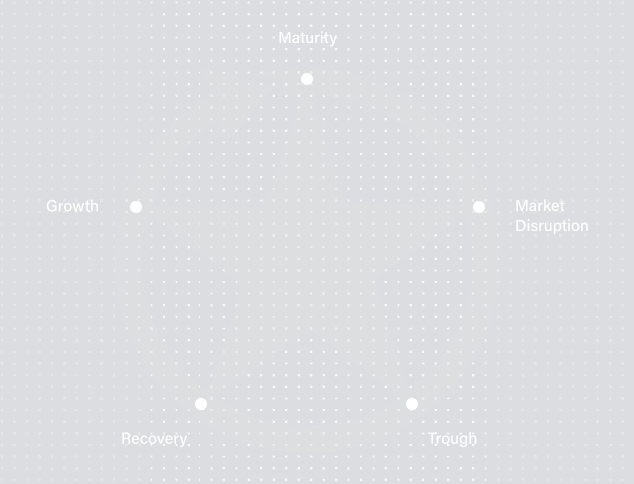

Such investment opportunities can be found throughout the cycle across all the asset classes in which Lone Star Funds invest, in pockets where asset prices are dislocated and a strong value creation strategy can provide solutions to complex problems.

Creating value in complex situations across any market conditions

We have the ability to work with counterparties to help them through complex transactions or times of limited liquidity to provide speed and execution certainty throughout every cycle, where unique circumstances can lead to an asset’s value being dislocated from its fundamental strengths.

Lone Star is well positioned to provide the capital and resource solutions these assets need to execute value creation strategies, focusing on factors like revenue growth, margin expansion, cash generation and M&A, rather than an over-reliance on multiple expansion or other broad measures of growth.

Our team, our platform and our experience allow us to identify and execute on these strategies, having a global track record of partnering with management teams to drive operational efficiencies, product optimization, capital structure improvements or enhanced procurement capabilities – areas which can reenergize a business.

Lone Star employs a sophisticated and comprehensive approach to risk management to first protect the downside.

Lone Star engages in opportunities created by complex situations and pockets of dislocation at any point in the cycle.

Maximizing stakeholder value

Our investors come first

Lone Star Funds invest beside and on behalf of a large and diverse group of limited partners that include state and corporate pension funds and their underlying beneficiaries, sovereign wealth funds, educational endowments, charitable foundations, insurance companies and family offices.

Responsible stewardship

We know we have responsibilities both as stewards of capital and as asset owners. Lone Star partners with management teams to make improvements to operations and assets and to build and optimize businesses, bringing to bear dedicated resources to enhance value. Committed to ethical and fair practices, we balance stakeholder interests — including those of investors, management teams, employees and counterparties — while adhering to recognized environmental, social and governance standards.

Careful execution

Lone Star Funds consider a broad scope of markets, industries and opportunities through equity and debt investments, focusing on assets and cash flow rather than sector or geography. While always cognizant of market conditions, our careful risk management and access to diverse financing sources and structures enable us to execute our strategies effectively through the cycle.

More speed, less haste

We strive for step-change improvements in the value of our investments in a short timeframe, enabling us to rapidly reduce risk while creating value to the benefit of stakeholders. This approach has served Lone Star well since its inception in 1995, allowing it to successfully deploy capital through some of the most turbulent financial cycles to strike developed economies since the 1990s.

Typical deal characteristics

CLICK TO LEARN MORE

We focus on controllable value creation levers in investment opportunities, providing us with the flexibility to invest through any market cycle

We have a long track record of investing at different points in an assets development and maturation, giving us the perspective to more accurately underwrite, no matter the current headwinds or tailwinds

Investments made in or projected to be held through mature stage of cycle attract greater risk management scrutiny which is part of our rigorous approach to investing

Partner with sellers to navigate highly complex transactions such as carve-outs and asset disposals where we can provide conviction and stability given our experience

Often sought in proprietary situations that demand high level of speed, certainty and innovative structures across multiple markets, products (both debt and equity) and asset types

Target investment opportunities where we can partner with management to effect near-term step change in an asset, creating immediate impact with pathway to value creation

Controllable risks carefully identified and global risk management function assesses risks to deal and across the portfolio

Conservative hedging dynamically managed to minimize risk while maximizing value creation

Deals with numerous exit strategies and financing options preferred, to permit rapid return of capital

Typical deal characteristics

CLICK TO LEARN MORE

We focus on controllable value creation levers in investment opportunities, providing us with the flexibility to invest through any market cycle

We have a long track record of investing at different points in an assets development and maturation, giving us the perspective to more accurately underwrite, no matter the current headwinds or tailwinds

Investments made in or projected to be held through mature stage of cycle attract greater risk management scrutiny which is part of our rigorous approach to investing

Partner with sellers to navigate highly complex transactions such as carve-outs and asset disposals where we can provide conviction and stability given our experience

Often sought in proprietary situations that demand high level of speed, certainty and innovative structures across multiple markets, products (both debt and equity) and asset types

Target investment opportunities where we can partner with management to effect near-term step change in an asset, creating immediate impact with pathway to value creation

Controllable risks carefully identified and global risk management function assesses risks to deal and across the portfolio

Conservative hedging dynamically managed to minimize risk while maximizing value creation

Deals with numerous exit strategies and financing options preferred, to permit rapid return of capital